How To Report Llc Taxes . Web llcs can report their taxes as the following business types: That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Tax classification options for llcs include sole. Web review information about a limited liability company (llc) and the federal tax classification process. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web here are three options:

from www.formsbank.com

Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Tax classification options for llcs include sole. That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llcs can report their taxes as the following business types: Web here are three options: Web review information about a limited liability company (llc) and the federal tax classification process.

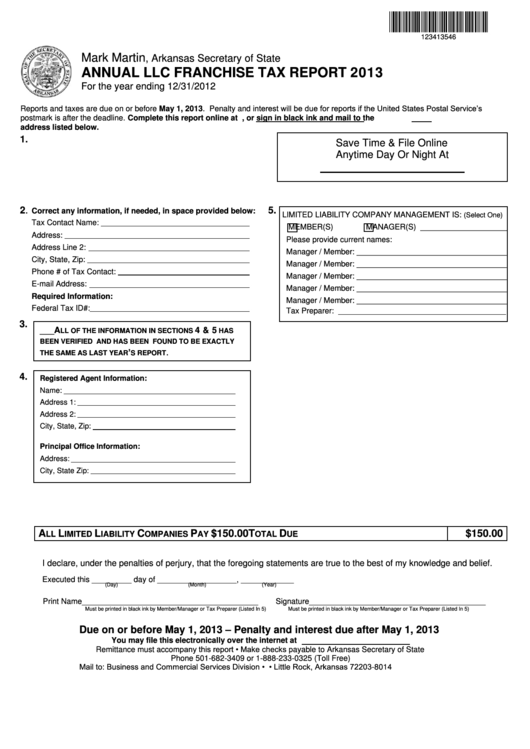

Annual Llc Franchise Tax Report Form Arkansas Secretary Of State

How To Report Llc Taxes Web llcs can report their taxes as the following business types: Web here are three options: That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llcs can report their taxes as the following business types: Tax classification options for llcs include sole. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web review information about a limited liability company (llc) and the federal tax classification process.

From www.youtube.com

Tax Difference between LLC and SCorp LLC vs. S Corporation How To Report Llc Taxes Web here are three options: That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web review information about a limited liability company (llc) and the federal tax classification process. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions,. How To Report Llc Taxes.

From howtostartanllc.com

Tax Writeoffs for LLCs Maximize Deductions TRUiC How To Report Llc Taxes That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web review information about a limited liability company (llc) and the federal tax classification process. Web llcs. How To Report Llc Taxes.

From www.benzinga.com

How and Where to File Taxes for LLC in 2021 • Benzinga How To Report Llc Taxes Web review information about a limited liability company (llc) and the federal tax classification process. That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llcs can report their taxes as the following business types: Tax classification options for llcs include sole. Web llc owners use the corporate tax return,. How To Report Llc Taxes.

From garciastaxservice.com

Liability Report How To Report Llc Taxes Web review information about a limited liability company (llc) and the federal tax classification process. That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llcs can report their taxes as the following business types: Web llc owners use the corporate tax return, also known as form 1120, to report. How To Report Llc Taxes.

From www.formsbank.com

Annual Llc Franchise Tax Report Form Arkansas Secretary Of State How To Report Llc Taxes Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web review information about a limited liability company (llc) and the federal tax classification process. Web here are three options: Tax classification options for llcs include sole. Web llcs can report their taxes as the following. How To Report Llc Taxes.

From npifund.com

How LLCs Pay Taxes NerdWallet (2022) How To Report Llc Taxes Tax classification options for llcs include sole. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web llcs can report their taxes as the following business types: Web here are three options: That individual will use form 1040 to report income generated from the business. How To Report Llc Taxes.

From www.patriotsoftware.com

Tax Forms for an LLC Federal Forms LLCs Should Know About How To Report Llc Taxes Tax classification options for llcs include sole. Web here are three options: That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web llcs can report their. How To Report Llc Taxes.

From www.llcuniversity.com

Texas LLC No Tax Due & Public Information Report LLCU® How To Report Llc Taxes Tax classification options for llcs include sole. Web here are three options: Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web review information about a limited liability company (llc) and the federal tax classification process. That individual will use form 1040 to report income. How To Report Llc Taxes.

From www.pinterest.com

How Do LLCs Get Taxed? Choosing a Tax Structure for Your LLC Llc How To Report Llc Taxes Tax classification options for llcs include sole. Web llcs can report their taxes as the following business types: Web here are three options: Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. That individual will use form 1040 to report income generated from the business. How To Report Llc Taxes.

From www.pinterest.com

How taxes work in an LLC Llc business, Tax, Tax return How To Report Llc Taxes Web llcs can report their taxes as the following business types: Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web review information about a limited. How To Report Llc Taxes.

From hoplerwilms.com

How to File Business Taxes for LLC in North Carolina How To Report Llc Taxes Tax classification options for llcs include sole. Web llcs can report their taxes as the following business types: Web here are three options: Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web review information about a limited liability company (llc) and the federal tax. How To Report Llc Taxes.

From www.youtube.com

SingleMember LLC Taxed as S Corp (2024) How to File SingleMember LLC How To Report Llc Taxes Tax classification options for llcs include sole. That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web here are three options: Web llcs can report their. How To Report Llc Taxes.

From vennlawgroup.com

LLC Taxation Options Which is best for your business? Venn Law Group How To Report Llc Taxes Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Tax classification options for llcs include sole. Web llcs can report their taxes as the following business. How To Report Llc Taxes.

From www.allbusinesstemplates.com

Annual Sales Tax Report Gratis How To Report Llc Taxes Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web llcs can report their taxes as the following business types: Web review information about a limited liability company (llc) and the federal tax classification process. That individual will use form 1040 to report income generated. How To Report Llc Taxes.

From www.patriotsoftware.com

How to File a Small Business Tax Return Process & Deadlines How To Report Llc Taxes Web llcs can report their taxes as the following business types: Web here are three options: Web review information about a limited liability company (llc) and the federal tax classification process. Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. That individual will use form. How To Report Llc Taxes.

From www.youtube.com

Chapter 1 Excel Part II How to Calculate Corporate Tax YouTube How To Report Llc Taxes Web review information about a limited liability company (llc) and the federal tax classification process. That individual will use form 1040 to report income generated from the business and schedule c to report expenses. Web llcs can report their taxes as the following business types: Web llc owners use the corporate tax return, also known as form 1120, to report. How To Report Llc Taxes.

From www.patriotsoftware.com

Small Business Tax Preparation Checklist How to Prepare for Tax Season How To Report Llc Taxes Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web review information about a limited liability company (llc) and the federal tax classification process. Web llcs can report their taxes as the following business types: That individual will use form 1040 to report income generated. How To Report Llc Taxes.

From www.iwillteachyoutoberich.com

LLC tax filing What you need to know as a solo entrepreneur Business How To Report Llc Taxes Web llc owners use the corporate tax return, also known as form 1120, to report the corporation’s income, gains, losses, deductions, and credits to. Web llcs can report their taxes as the following business types: Web here are three options: Web review information about a limited liability company (llc) and the federal tax classification process. That individual will use form. How To Report Llc Taxes.